I can remember being a little girl, sitting absolutely still and listening with an open heart to stories of how people meet, fall in love, and live happily ever after. Really, it’s beautiful. But I’m here to ask why no one ever feels compelled to also mention that dating can be pretty financially draining. And what about how financial matters impact marriage?

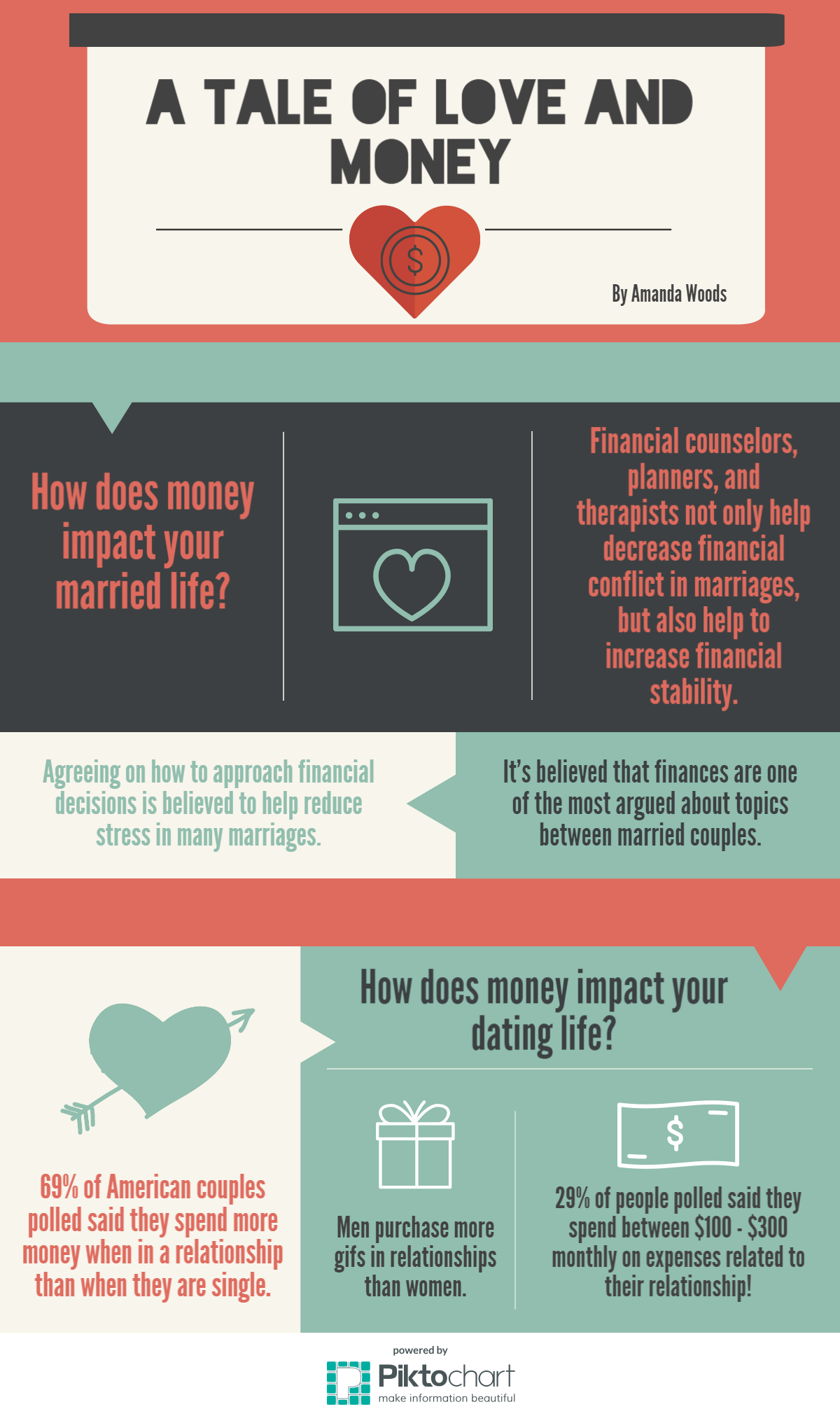

It’s a tale as old as time – two people meet and then proceed to spend a lot of money on dates, gifts, etc. A National Endowment for Financial Education survey (NEFE) suggests that many of those polled claimed to spend far more money when in a relationship than when single. In fact, the same survey also explains that many spend around $100-$300 extra a month on expenses that are directly related to their relationship or significant other. It is believed that many relationships can be strengthened by having conversations about money and financial attitudes(PDF) from the early stages, so that those lines of communication are open and can make way for a healthier financial foundation later on. As an added bonus, this can also help reign in the excess spending that tends to occur while dating.

And what about marriage? It’s no secret that financial stress is one of the largest causes for conflict in many marriages. Because of this, couples should work to actively communicate about their finances and financial situation. This will allow each person to find common ground, and understand each other’s views on money and how each uniquely approaches this topic. Once this happens, couples are far more likely to find a place where they can agree on how to approach financial decisions together, which one study suggests helps to reduce unnecessary financial strain on the relationship. Additionally, it is suggested that financial counselors, planners, and therapists not only help decrease financial conflict in marriages, but also help to increase financial stability.

And what about marriage? It’s no secret that financial stress is one of the largest causes for conflict in many marriages. Because of this, couples should work to actively communicate about their finances and financial situation. This will allow each person to find common ground, and understand each other’s views on money and how each uniquely approaches this topic. Once this happens, couples are far more likely to find a place where they can agree on how to approach financial decisions together, which one study suggests helps to reduce unnecessary financial strain on the relationship. Additionally, it is suggested that financial counselors, planners, and therapists not only help decrease financial conflict in marriages, but also help to increase financial stability.

The bottom line is simple – open the lines of communication in your relationship, whether you’re married or dating, to include conversations about money and spending. Start to understand how financial decisions impact the health of your relationship, and how they may continue to as you move forward.

Then, of course, live happily ever after.

Sources for article and Infographic:

National Endowment for Financial Education

University of Arkansas Cooperative Extension Service

Financial Therapy Association – Journal of Financial Therapy