The Ohio State University Extension program “Real Money. Real World.” involves a series of financial education lessons followed by a real-life budgeting simulation activity in which students are assigned a job with a corresponding salary and a family to care for.

The Ohio State University Extension program “Real Money. Real World.” involves a series of financial education lessons followed by a real-life budgeting simulation activity in which students are assigned a job with a corresponding salary and a family to care for.

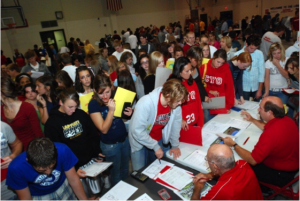

For the simulation, students wear the hat of 27-year-old adult and main income earner in their pretend family, and they use their assigned monthly salary to budget for the needs of their family for one month’s time. This includes visiting different “stations” and purchasing food, transportation, insurance, housing and more. The purchases they make are specific to their family. For instance, if their family includes three children, their food cost reflects that. If they have a baby, they need to buy diapers, and so on.

Each “purchase” they make is deducted from their monthly income, and their role is to make smart purchases for their family and balance the budget – which they quickly learn often means making many sacrifices.

I’ve had the privilege of conducting this program at four middle schools locally and have seen about 800 eighth graders through the program so far this year. It is always so interesting to hear the students’ feedback at each school, and while the students are each unique, I hear the same comments from so many of them. Their consistent feedback tells me that there are some basic, yet very important concepts that young teens are not aware of when it comes to personal finance. Some of the comments I hear repeatedly are…

- “I’m definitely not having kids until I can afford it”

- “Now I’m going to try harder in school so that I can go to college and get a good education and a good job”

- “Food is so expensive”

- “Now I know why my parents always say ‘no’ when I ask them to buy me things”

- “Life as an adult is hard!”

- “It can be difficult to get your ‘wants’ after you’ve met your ‘needs’”

With these sentiments (or very similar ones) shared by an overwhelming number of the eighth graders, it’s safe to say that this activity is often their first real look into what it means to be a responsible adult when it comes to money. These students are not always aware of the difference an education can make in earning potential, and they often don’t realize that caring for children is costly… until they do this activity.

The good news is that a recent survey, conducted online by Harris Poll on behalf of NEFE and Jump$tart, finds that more than three in five families with kids under the age of 18 (62 percent) had talked about money matters within the past week. So, if you have a middle schooler at home, take some time to talk to them about the reality of how all ‘adult’ expenses can really add up. Show them one month’s worth of grocery receipts, help them calculate the percentage of income that housing costs account for in your household, or take a look at this chart, which shows the median income of people at different education levels. Find some way to get this important conversation started.

Another helpful resource to start talking about personal finance with your kids is http://moneyasyougrow.org – where you can select your child’s age and the site will tell you age-appropriate lessons to teach your children, and easy activities to reinforce those lessons. For example, by age 13, kids should know to save a dime for every dollar that they earn.

It’s never too early to get the conversation started about personal finance, and remember that you serve as a financial role model for your children, whether you realize it or not …and whether they realize it or not!