Why it matters. Throughout life we face many events and situations that require us to make decisions about our financial lives. Being financially literate, or understanding how finances work in our everyday lives, can not only better prepare us to make these decisions, but will also improve outcomes in our financial lives. In fact, our financial literacy can impact several areas of our financial wellbeing, including whether or not we have savings, the amount of debt we incur, and even whether we’re making ends meet each month. Financial wellbeing has the added benefit of positively impacting other aspects of life as well – from relationships, to health, to your ability to succeed at work.

Why it matters. Throughout life we face many events and situations that require us to make decisions about our financial lives. Being financially literate, or understanding how finances work in our everyday lives, can not only better prepare us to make these decisions, but will also improve outcomes in our financial lives. In fact, our financial literacy can impact several areas of our financial wellbeing, including whether or not we have savings, the amount of debt we incur, and even whether we’re making ends meet each month. Financial wellbeing has the added benefit of positively impacting other aspects of life as well – from relationships, to health, to your ability to succeed at work.

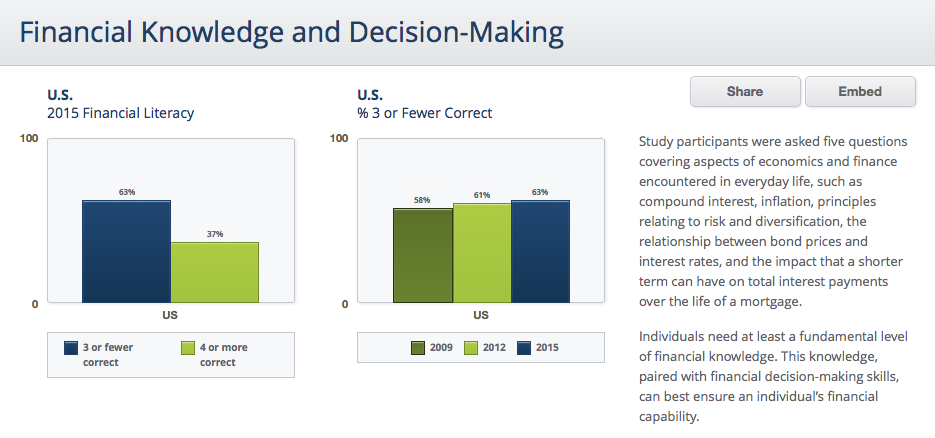

An article from the Journal of Economic Inquiry used data from a recent FINRA Foundation study to conclude that adults who are less financially literate are far more likely to have both short and long term negative impacts due to costly financial decisions. The data gathered from this study was striking, and showed that financial literacy rates have decreased since 2009, with many of the respondents testing below average on various indicators of financial literacy.

For example, the graph below reflects the respondents’ financial knowledge and decision making. As you can see, out of the five questions asked, the majority of respondents scored only 3 or fewer correctly.

In addition, the study also shows that our perception of our financial literacy may also impact the effectiveness of our financial decisions. For instance, if we doubt our ability to make sound financial decisions, this lack of confidence may negatively impact our decision making. In contrast, if we feel positively about our financial literacy, we may be more likely to make decisions that positively impact our financial health and wellbeing. Developing a sense of confidence where financial matters are concerned can help you make better choices.

What you can do. Because our level of financial literacy impacts our financial health and wellbeing, it is important to do what you can to ensure you understand and are confident about your financial decisions. Here are a few steps you can take:

Do your research. When it comes to financial matters, it is always best to do your research to ensure that you understand your financial decisions. Do you know how quickly compound interest makes your current savings grow? Do you know the difference between stocks and mutual funds? Is it better to pay off debt or keep cash in the bank? If you don’t know the answer to these questions or others, there are many resources available to help you – whether they be at your local library or Extension office, or through various online resources such as MyMoney.gov, and others available through the U.S. Department of Treasury.

Ask questions. If you’re ever unsure about a financial decision that you are facing, you should always feel comfortable asking questions until you feel ready to confidently move forward! Reach out to your local extension office to see if there is an agent that can provide the necessary resources, or look into whether there are low or no cost financial counseling services in your area. Never feel pressured into making financial decisions that you are unsure about, and always feel comfortable asking the necessary questions to put you on the path to financial health and wellbeing.

Take a class. OSU Extension Family & Consumer Sciences offers a variety of free financial literacy education available to you right in or near your community! These programs exist to empower you and your loved ones to make the best financial decisions possible, and improve your financial confidence. Reach out to your local Extension office to find out what financial literacy education is available to you, and get started improving your financial literacy today!