Prepare yourself for a shock: our national student loan debt is now more than one trillion dollars! This is more than our national credit card debt. So is college still a good investment?

Prepare yourself for a shock: our national student loan debt is now more than one trillion dollars! This is more than our national credit card debt. So is college still a good investment?

It’s Not All Bad News

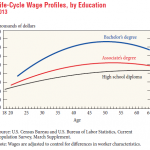

Last month the Federal Reserve Bank of New York reported that attending college is still a good investment for your financial future. Over their lifetime, workers with a bachelor’s degree earn over $1 million more than those with only a high school degree.

Grants and scholarships are being used more and more by students and parents to pay for college. This type of free money now pays for an average of 31% of college costs, up from 25% four years ago, according to Sallie Mae. But that leaves 59% of college costs to be covered by students. In the 2014 Sallie Mae study, parents covered an average of 37% of college costs and students paid for 27%. If college is still a good investment, how do you build your savings and find as much free money as possible to reduce the cost?

5 Tips for Saving for College

- Start Saving as Soon as Possible – Even if you have to start small, any regular saving will build up over time and reduce your need for loans. Two popular ways to save are through 529 plans and savings bonds. There is a lot to know when choosing a savings option, so visit the links to learn more.

- Get the Free Money! – Did you know there are billions of dollars available in grants and scholarships for those willing to find the applications and apply? Grants and scholarships can be gifts that save you thousands in interest you would have had to pay back later. Try StudentAid.ed.gov, go.salliemae.com/scholarship, and https://bigfuture.collegeboard.org/pay-for-college.

- Work up to 15 Hours Each Week While You’re in School – Any money you save or earn before and during college will reduce the amount of loans you need to pay back later! Research shows that 15 hours seems to be the divider – working 1-15 hours tends to increase GPA, while working more than 15 hours each week tends to adversely affect academic success and increase time to graduate.

- Consider Your Options – College costs a lot. You may have your heart set on attending an Ivy League school, but can you afford it? Compare the amount you will need to pay at different colleges. Research shows that higher student loan debt is associated with lower overall life satisfaction.

- Get Tips and Reminders to Save – Ohio Saves can help students and their parents keep college savings in focus. Sign up for our free text message tips and reminders by taking the Pledge to Save and choosing “Education” as your savings goal.